Compassion at Home: Choosing Cruelty-Free Products for a Kinder Living Space

By Brittany Loney | REALTOR®

Creating a beautiful home starts with kindness. Learn how to make compassionate, cruelty-free choices when selecting everyday home products. From understanding labels to finding ethical brands, here’s how to align your home and heart with animal-friendly living.

As homeowners, we all want our spaces to feel comfortable, clean, and welcoming. But what if the very products we use to create that sense of home are harming animals in the process? As someone who values both beautiful living spaces and compassionate choices, I believe a truly happy home is one that reflects kindness, not only toward our family and pets, but toward all living beings.

Why Cruelty-Free Matters

Cruelty-free products are those developed without testing on animals at any stage of production. By choosing them, you’re supporting brands that prioritize innovation, ethics, and compassion. The movement goes beyond personal care items and now includes everything from cleaning sprays to furniture polish and laundry detergent.

Making the switch doesn’t just align with animal welfare values. It also helps create a healthier home environment. Many cruelty-free brands emphasize non-toxic and plant-based ingredients, meaning fewer harsh chemicals lingering in your air, on your countertops, or around your pets.

Labels to Look For: A Beginner’s Guide

If you’re just starting out, these logos make cruelty-free shopping simple and stress-free. Keep an eye out for these trusted certifications next time you’re in the store:

-

Leaping Bunny 🐇

-

The gold standard of cruelty-free certification.

-

Guarantees no animal testing was done at any stage of product development.

-

Accepted globally, and you can verify brands through their official app or website.

-

-

PETA’s Beauty Without Bunnies

-

Certifies that products and ingredients are not tested on animals.

-

Often includes a “Vegan” logo if the product is also free from animal-derived ingredients.

-

-

Choose Cruelty Free (CCF)

-

An independent Australian organization that certifies cruelty-free brands worldwide.

-

Focuses on ethical sourcing and transparency.

-

-

Vegan Society 🌿

-

Indicates the product is both cruelty-free and free of any animal-derived ingredients.

-

Great for shoppers who want to avoid animal products entirely.

-

-

Certified B Corporation (B Corp)

-

Not a cruelty-free label specifically, but signals a company’s overall ethical and sustainable practices.

-

Brands with this certification often prioritize cruelty-free and eco-conscious standards.

-

Tip: Download the Leaping Bunny or Cruelty-Cutter app for quick barcode scans and instant verification while shopping.

Home Products to Choose or Avoid

A compassionate home starts with conscious choices. Here’s a quick guide to everyday swaps:

Choose:

-

Cleaning products: Method, Seventh Generation, Ecover, Attitude, or Mrs. Meyer’s Clean Day

-

Laundry detergents: Ecos, The Honest Company, or Puracy

-

Candles & air fresheners: Opt for soy or coconut wax candles with natural essential oils instead of paraffin-based ones tested on animals.

-

Paints & finishes: Look for low-VOC, cruelty-free options like Benjamin Moore’s Natura or ECOS Paints

Avoid:

-

Brands that don’t disclose testing policies or use animal-derived enzymes in detergents

-

Products containing animal fat–based surfactants or wax additives

-

Harsh chemical cleaners that aren’t biodegradable or pet-safe

Making Compassion a Feature in Every Home

Whether you’re staging a property, decorating your new home, or refreshing your cleaning routine, cruelty-free living can easily become part of your real estate lifestyle. Showcasing a home filled with eco-conscious, ethically sourced products not only appeals to modern buyers but also tells a story of care, responsibility, and mindfulness.

After all, home isn’t just where we live; it’s a reflection of who we are. By choosing cruelty-free, you’re creating spaces that radiate warmth, wellness, and heart.

Final Thought:

Small switches lead to big change. As homeowners and animal advocates, we have the power to shape environments that are both beautiful and kind for every creature who shares this planet with us.

As the leaves start turning and the air gets a little crisper here in Kelowna, it’s the perfect time to show your home some seasonal love. Whether you’re a new homeowner or have lived in your place for years, fall is more than just pumpkin spice and cozy sweaters, it’s also a key season for maintenance and smart renovations.

Taking care of your home now can help prevent costly issues down the road, boost your comfort, and even increase your property value.

Here are some helpful fall homeownership tips and renovation ideas to keep in mind as the seasons shift:

1. Seal Up Drafts & Improve Energy Efficiency

Kelowna winters aren’t extreme, but they can sneak up on you. Use fall as your window to get ahead of those rising heating bills.

To-do:

-

Check for drafts around windows and doors.

-

Add weather stripping or caulking where needed.

-

Consider upgrading to energy-efficient windows if yours are outdated.

Pro tip: A simple door sweep can make a big difference in keeping cold air out and heat in!

2. Gutter Cleaning: Not Glamorous, But Necessary

Once the leaves start falling, it’s time to show your gutters some love. Clogged gutters can lead to water pooling around your foundation or even ice dams in the winter.

To-do:

-

Clean out gutters and downspouts.

-

Ensure water is draining away from your home.

-

Check for signs of wear or sagging.

Bonus: This is a great excuse to pull out the ladder and give your roof a quick once-over, too.

3. Create a Cozy Outdoor Space You Can Actually Use

Just because summer is over doesn’t mean patio season has to be. Small updates can help you enjoy your outdoor space well into the fall.

Ideas:

-

Add a firepit or patio heater.

-

Swap in warm-toned string lights or lanterns.

-

Invest in weather-resistant throws or cushions.

Picture this: a glass of local wine, wrapped in a blanket, watching the sunset over the valley from your own backyard.

4. Paint Touch-Ups & Interior Refreshes

Fall is a great time to tackle those small indoor projects that make your home feel fresh and inviting before the holiday season.

Ideas:

-

Paint a feature wall in a warm, seasonal tone.

-

Update cabinet hardware or light fixtures.

-

Refresh your entryway with a new rug or mirror.

These are simple upgrades that can elevate your space without a full reno budget.

5. Furnace & Fireplace Prep

Nothing says “home” like the first fire of the season, but it’s no fun when your furnace or fireplace isn’t ready to go.

To-do:

-

Schedule a professional furnace inspection and replace filters.

-

Clean your chimney if you have a wood-burning fireplace.

-

Test your carbon monoxide and smoke detectors.

A warm, safe home is a happy home.

Final Thought: Fall is the Season of “Settling In”

As a local realtor and homeowner myself, I love how fall invites us to slow down and enjoy the comforts of home — whether that means cozying up with loved ones or finally crossing those little tasks off your list.

If you’re thinking about future renovations, prepping to sell, or just want to make the most of your space this season, I’d love to be a resource for you.

Let’s Connect!

Let’s Connect!

Need contractor recommendations? Curious about which renovations add the most value in Kelowna? I’m happy to share advice, local contacts, or just chat about your home goals, no pressure.

Wishing you a cozy and productive fall season,

— Brittany Loney, Your Okanagan REALTOR® | (250)801-0636 | brittany.loney@century21.ca

Whether you’re looking to buy in the bustling city of Kelowna or sell a serene property in Vernon, the topic of smart home security is becoming increasingly relevant. Many clients often ask:

“Do security cameras really influence the buying or selling process?”

It’s an excellent question, and the answer is more complex than it appears.

Smart home security systems, such as Ring doorbells, Google Nest cameras, and motion-activated lighting, are gaining popularity across Canada. In the Okanagan, these systems are found in everything from new developments to lakeside homes and rental properties. While they offer enhanced security, they also raise questions about privacy, legality, and their impact on resale value.

Let’s break down the essentials to help you make informed decisions—whether you’re buying, selling, or planning for the future.

Sellers: Enhancing Resale Value with Smart Security

For sellers, a smart security system is often seen as an added perk, particularly in homes where safety and convenience are priorities for potential buyers. While it may not significantly increase the property’s monetary value, it can certainly make your home more appealing, especially to tech-savvy buyers.

If you’ve installed such a system, it’s considered a fixture and should be disclosed during the sale process. Some sellers opt to include the system in the sale, while others prefer to take it with them. Ensure this is clearly outlined in the contract.

💡 Pro Tip for Sellers: If you use cameras during showings, you must disclose this to potential buyers. While video monitoring can be acceptable, recording audio without consent is illegal in Canada. 💡

Buyers: Evaluating Smart Home Security Features

When viewing homes in the Okanagan, you might encounter existing security systems. Consider asking:

- Is the system owned or leased?

- Will it be included in the sale?

- Are there recurring subscription fees?

- Will any components be removed by the seller?

Many buyers see a pre-installed security system as a valuable addition, but others may prefer to choose their own devices or avoid systems with ongoing contracts.

Think about your lifestyle: Do you travel frequently? Do you receive a lot of deliveries? Are you located in a bustling area? A smart security system might offer more convenience than you realize.

Condos and Rentals: Special Considerations

For those buying condos in Kelowna or renting in Vernon, there are specific rules regarding shared or common areas.

- Condo owners must adhere to strata bylaws, which may limit external cameras or require approval.

- Renters need written permission from landlords before installing any security devices, particularly those that are mounted or wired.

- Cameras should not be installed to monitor hallways, neighbors’ doors, or shared spaces.

Respecting neighbors’ privacy is not just courteous, it’s a legal obligation under Canadian privacy laws.

Using Cameras During Showings: Important Guidelines

Sellers may wish to monitor their property during showings, and cameras can help prevent unauthorized access. However, audio recording is strictly off-limits. In Canada, recording private conversations without consent is a criminal offense. If you decide to use cameras:

- Inform your listing agent

- Place visible notices near entry points

- Avoid recording audio

Monitoring for safety is acceptable… spying on Buyer conversations is not.

Legal Risks of Misusing Cameras

Improper use of cameras can lead to legal issues. There have been cases in BC, Alberta, and Ontario where individuals faced lawsuits for privacy violations, often due to cameras aimed at neighbors’ properties.

To stay compliant:

- Keep cameras focused on your own property

- Avoid audio recording

- Disclose camera usage to visitors or buyers

If unsure about your setup, especially in shared buildings, consult your condo board or a legal expert.

Smart Security Systems: A Summary for Buyers and Sellers

Smart security systems can provide significant benefits during and after a sale, but they must be used responsibly.

As a seller, these systems can modernize and secure your listing. Be transparent about their use.

As a buyer, ask the right questions about the system’s ownership and any service agreements that may apply.

Let’s Talk About Tech-Savvy Real Estate

Are you considering buying or selling a property with smart features? I’m here to offer expert guidance every step of the way.

As a local expert with Century 21 Assurance Realty Ltd., I assist clients throughout Central and North Okanagan with everything from smart home upgrades to understanding market value, ensuring your home is safe, secure, and ready for sale.

📩 Feel free to contact me to discuss your goals or ask questions.

📱 Find me on Instagram @BrittanyLoneyRealtor

Here’s to safer homes, smarter decisions, and real estate that works for you.

—

Brittany Loney | REALTOR®

Century 21 Assurance Realty Ltd.

Proudly serving Central & North Okanagan

As a 32-year-old, Kelowna born and raised REALTOR®, I’ve helped many clients navigate the ups and downs of the real estate market. However, recently, I found myself on the other side of the transaction. I sold my own investment property, a move I thought would be straightforward, even exciting. I had watched the market soar in the past few years, so naturally, my expectations were high.

But the current conditions taught me a humbling and valuable lesson: the importance of framing expectations around present-day realities, not yesterday’s trends.

The Expectation vs. The Reality

When I first purchased the property, the market, especially here in the Central and North Okanagan, was hot. Homes were selling in days, often above asking, with bidding wars that drove prices higher. It felt like a smart, safe investment.

Fast-forward to today, and while the Okanagan remains an attractive region with a steady flow of interest, the pace and behavior of the market have changed. Rising interest rates, cautious buyers, and increased inventory have all contributed to a new kind of dynamic, one where patience, pricing strategy, and adaptability matter more than ever.

When I listed the property, I anticipated strong offers, maybe even multiple. Instead, I encountered a slower pace, more negotiation, and ultimately had to re-evaluate what success looked like in this new market climate. That meant adjusting the list price, staying flexible, and accepting that while I still walked away with a positive return, it wasn’t the windfall I once envisioned.

What This Taught Me as a Realtor

This experience reminded me of something I often explain to my clients but now feel more deeply than ever: the market doesn’t care what you paid, what your neighbor sold for last year, or what your original plan was. It’s about what’s happening right now; current demand, current rates, and current buyer behavior.

Even as a professional, it was a challenge to shift my mindset. Selling a property, especially one you’ve invested your own time, money, and emotion into, can feel deeply personal. But ultimately, real estate success comes from making informed, strategic decisions rooted in today’s data-not in hopes or hindsight.

For My Clients: Real Guidance from Real Experience

I’m sharing this story not just as a cautionary tale, but to help my clients feel seen. If you’re thinking of selling and feeling overwhelmed, uncertain, or even a little disappointed with how things are shaping up, you’re not alone. I’ve been there… literally. I’ve had to absorb the shift between expectations and reality, and I’ve come out of it with deeper empathy and sharper strategy.

If anything, this experience has made me a better realtor. It reinforced how important it is to be honest, informed, and supportive when helping sellers navigate shifting markets like the one we’re seeing now across the Central and North Okanagan. That includes Kelowna, Lake Country, Vernon, and the surrounding communities-each with its own micro-market influences and buyer trends.

Why It Matters in the Okanagan Market

We’re still in a beautiful, in-demand region. The Okanagan continues to attract buyers from across the province and beyond, but the urgency and conditions of 2021 and 2022 simply aren’t the same. And that’s okay.

The key is knowing how to adapt. That means pricing smartly from day one, understanding local trends, and being prepared to negotiate not from a place of panic, but from a position of strategy. And that’s exactly what I bring to the table, both as a realtor and someone who just walked the path personally.

Final Thoughts

Markets change. What doesn’t change is the importance of working with someone who isn’t just a salesperson, but a true partner, someone who understands both the numbers and the emotions behind every decision.

So, whether you’re selling an investment property, your first home, or just considering your options, remember this: your goals are valid. With the right guidance, you can make confident, informed decisions; even in an unpredictable market.

Let’s talk about where the market is today, and how we can move forward together.

📍 Proudly serving Kelowna, Vernon, Lake Country & the surrounding Central and North Okanagan areas

📞 Thinking about selling or just want a market update tailored to your property? Let’s connect!

Sippin’ Rosé & Signing Deals: Why Summer in Kelowna is THE Time to Buy or Sell

By Brittany Loney - REALTOR®

Hey friends! It’s officially that time of year in Kelowna. Sunshine, sandy toes at Gyro Beach, lake days on the pontoon, and yes... hot real estate vibes.

Whether you’re dreaming of leveling up your living situation or thinking about cashing in on that cute character home, summer in the Okanagan isn’t just for wine tours and paddleboarding. It’s actually the busiest and best season to make your real estate move. Let’s spill the (iced) tea on why buying or selling in Kelowna during the summer just makes sense. 👇

For My Home Sellers: Your Time to Shine (Literally)

Kelowna curb appeal is next-level in the summer. The lake sparkles, gardens are blooming, and those mountain views? Unreal. Your home never looks better than when the sun’s out and the vibes are high.

-

Landscaping magic: A little lawn care goes a long way in helping your property pop.

-

Golden hour showings: Long summer days = more flexible showing times for buyers. Sunset viewings? Yes, please!

-

Lifestyle sells: Highlight that dreamy patio, pool, or proximity to the lake. In Kelowna, the summer lifestyle is the selling point.

Bonus tip: If your home has a/c, a shaded yard, or a cool basement suite—those are hot (well, cool) commodities in July heat.

For My Buyers: Yes, You CAN Have It All

Looking to buy? I see you. Maybe you're ready to stop renting that high-rise downtown and start building some equity or finally snag that townhome near Knox. Summer is prime time to explore.

-

More inventory: Summer often brings more listings, especially in family-friendly neighbourhoods like Kettle Valley, Glenmore, or Wilden.

-

See homes at their best: You get to see how homes function in the heat, how the backyard really feels, and what the natural light situation is like in real time.

-

Neighbourhood vibe check: Walk the block, hit a local brewery, and see what your future Friday nights might look like.

Vacation Homes & Airbnbs? You Bet.

Thinking investment? Summer is when waterfront cottages and short-term rental properties are at peak demand. Areas like West Kelowna Estates, Lakeview Heights, or Peachland are full of potential. Plus, let’s be honest, owning a place where you can sip wine and dip your toes in the lake? Not the worst idea you’ve had.

Local Tip: Be Ready to Pounce

Kelowna’s summer market moves fast. Get pre-approved, make your wishlist, and let’s chat strategy. I’ve got the inside scoop on new listings and neighborhood secrets that don’t show up on MLS.

Final Thoughts (From a Local Who Loves Her City)

Summer in Kelowna is magic and so is this real estate window. Whether you’re buying, selling, upsizing, downsizing, or just manifesting your lakeview dream, this is the time to make moves. Let’s grab a cold brew (or a glass of rosé!) and chat about your next step. I’m here to help make real estate feel less stressful and a whole lot more fun.

How to Protect Your Home from Wildfires: Smart Strategies for Safety and Peace of Mind

With hotter, drier summers becoming the norm, wildfires are no longer a distant risk—they’re a reality many homeowners face each year. If you live in a wildfire-prone area, taking action now could be the difference between minor damage and devastating loss. The good news? There are concrete steps you can take to better defend your home and prepare for emergencies, both physically and financially.

Here’s a guide to help you fireproof your property, prep for the unexpected, and understand how your insurance coverage plays a vital role in protecting what matters most.

Establish a Wildfire Defense Zone

Creating a defensible space around your home is one of the most effective ways to reduce wildfire risk. Think of it like building a buffer between your home and any approaching flames. Consider this two-step approach:

Wildfire Defense Zone One

- Clear Flammable Materials: Ensure the first 10 meters surrounding your home are free of combustible materials like dry grass, vegetation, firewood, and fuel.

- Use Fire-Resistant Materials: Construct exterior properties, such as decks and sheds, with fire-resistant materials or locate them more than 10 meters from your home.

- Proper Firewood Storage: Store firewood over 10 meters away from your home in a fire-resistant box or under a fire-resistant tarp.

- Non-Combustible Patio Furniture: Opt for metal or other non-combustible materials for patio furniture, or keep it away from your home.

Wildfire Defense Zone Two

- Maintain vegetation. Prune trees so they’re 3–6 metres apart. Remove dead plants and stumps, and keep grass well-watered and trimmed.

- Thin out tree canopies. This reduces the chance of a crown fire, which can spread rapidly from treetop to treetop.

Prepare Your Home for Wildfire Season

Beyond your yard, your home itself needs to be prepared to withstand embers and heat. In addition to establishing a defense zone, consider these preparations:

- Chimney Maintenance: Inspect and clean your chimney regularly, ensuring dampers work properly.

- Air Quality: Invest in a portable air cleaner to maintain low indoor air pollution levels during smoky conditions.

- Roof and Gutter Cleaning: Regularly clear debris from your roof and gutters to prevent ember ignition.

- Fire-Resistant Building Materials: Use materials like metal or treated asphalt shingles and brick siding, as wood and vinyl are highly flammable.

- Window and Door Protection: Install tempered and thermal windows and doors to minimize wildfire heat penetration.

- Safe Storage of Explosives and Fuels: Keep explosive materials like propane and gas at least six meters away from your home, and cover firewood with fire-resistant covers.

Secure Your Home During a Wildfire Evacuation

In the event of an evacuation, these steps are crucial to protect your home:

- Close all windows and doors, and seal vents and openings.

- Bring patio furniture and outdoor items inside if possible.

- Position fuel sources over six meters from your home.

- Water down the roof, exterior walls, and surrounding areas.

- Connect and ready water hoses for use.

- Turn off the gas supply.

- Ensure emergency services have clear access to your property; open gates for emergency vehicles.

Understanding Wildfire Insurance

Navigating insurance coverage is vital for homeowners in wildfire-prone areas. Standard property insurance policies typically cover damage from wildfires, including smoke and water damage. Here are key considerations:

- Coverage Limits: Ensure your policy covers the costs of replacing or repairing your home and valuables.

- Renovations: Reflect any recent renovations in your policy to account for increased home value.

- Additional Living Expenses: Coverage can help with temporary relocation costs, like hotels and meals, during an insured loss.

- Food Spoilage: Coverage may replace fridge or freezer contents if a wildfire causes a power outage.

Importance of a Home Inventory List

A home inventory list can streamline the claims process if your property sustains fire-related damage:

- Document possessions with detailed descriptions, serial numbers, purchase dates, and estimated values.

- Keep and store receipts safely, with digital copies if possible.

- Consider 360-degree videos of your home’s interior and exterior.

- Store the inventory list securely, with a copy kept offsite.

Stay Safe During a Wildfire

- Stay informed of wildfire risks through authorities.

- Be ready to evacuate with an emergency kit and a fueled vehicle.

- Report any wildfires and move to safety without attempting to extinguish them personally.

- Protect against smoke by closing windows and doors, and sealing openings.

- If time allows, move flammable items indoors and prepare your property with water access.

By following these comprehensive steps, homeowners can significantly reduce the risks associated with wildfires and ensure their properties are well-protected and adequately insured. Wildfires are unpredictable, but your response doesn’t have to be. With a bit of planning, some simple yard work, and the right insurance coverage, you can drastically reduce your home’s vulnerability and ensure peace of mind during wildfire season.

Being prepared isn’t about living in fear—it’s about taking control and knowing you’ve done everything possible to protect your home, your family, and your future.

Are you spending too much time sorting, washing, and folding laundry? No one wants to waste precious time in the laundry room, regardless of its size. Here are our favorite tips and tricks to transform your laundry space into an efficient and beautiful area that you’ll actually look forward to using.

Effective & Attractive Storage Solutions:

We all know how many products are needed to achieve sparkling clean clothes, but there’s no reason to display mismatched items. Instead, conceal your cleaning supplies in coordinated boxes, baskets, or crates. For frequently used items, like detergent or dryer sheets, consider using clear jars to add a decorative touch. Don’t forget to label the boxes and jars for quick access to what you need.

Time-Saving Sorting:

Utilize labeled baskets to pre-sort your laundry, helping you stay organized and saving time. This simple task can be taught to the entire family, preventing a massive pile of dirty clothes from accumulating. For added convenience, choose sorting baskets with wheels to make transportation a breeze!

Drying Solutions:

While hang drying is essential for certain garments, not all laundry rooms are designed for it. A straightforward solution is to install tension rods or a foldable drying rack. Tension rods can be placed almost anywhere, making them a versatile addition to any laundry space. Alternatively, a fold-down drying rack is ideal for smaller areas, as you can easily tuck it away when it’s not in use.

Check out this DIY drying rack.

Showcase Your Ironing Station:

While wall-mounted ironing boards may be outdated, you can still create a stylish and accessible ironing station. Install an open shelf to store your iron, spray bottle, cloths, and other essentials. Below the shelf, add two small hooks for your ironing board. Transform your ironing station into a decorative wall feature by concealing your iron and supplies in decorative boxes, and updating your ironing board cover to complement your decor.

Establish a Folding Area:

A laundry room can’t function efficiently without a designated space for folding clean clothes. Consider adding a countertop over your front-loading washer and dryer to create a generous folding station. If you have a different setup, incorporate a desk or table that suits your area. For those with limited space, a drop-down wall table is an excellent solution, allowing you to stow it away when not in use.

Check out this DIY folding table tutorial.

Maximize Your Space:

Optimize your laundry room, regardless of its size, by utilizing every inch effectively. Make use of vertical space by incorporating floating shelves or coat hooks to hold cleaning supplies, baskets, or clothing. Don’t overlook your door! Install plastic shelving inserts or over-the-door organizers for smaller items.

Bonus Tip:

Keep a Stool Nearby – This straightforward suggestion will prove useful more often than you might think! Having a small stool (or a foldable step ladder if space is limited) will enable you to effortlessly access hard-to-reach items, saving you both time and energy!

DIY Project: Make Your Own Laundry Detergent

DIY Project: Make Your Own Laundry Detergent

This cost-saving project will leave your clothes clean and fresh with ingredients you can buy at your local supermarket.

Check it out here.

Home Buying Programs and Incentives

BRITTANY LONEY - REALTOR®

The Government of Canada offers home buying programs and incentives for homebuyers. These can help you purchase your home. The programs and incentives include the following:

The Home Buyers’ Amount

You may be eligible to receive a non-refundable tax credit of up to $1,500.

Learn more about the Home Buyers' Amount

GST/HST New Housing Rebates

You may be eligible for a rebate for some of the tax you pay when buying your home.

Learn more about the GST/HST New Housing Rebates

The Home Buyers’ Plan (HBP)

You may withdraw up to $60,000 from your registered retirement savings plan (RRSP) tax-free to buy your first home.

Learn more about the Home Buyers' Plan

Newly Built Home Exemption

The newly built home exemption reduces or eliminates the property transfer tax on qualifying purchases of a principal residence.

Learn more about the Newly Built Home Exemption

Secondary Suite Incentive Loan Program

Forgivable loans up to $40,000 for homeowners to build and rent an affordable secondary suite at below market rates to increase affordable rental supply.

Learn more about the Secondary Suite Incentive Loan Program

FIRST TIME HOME BUYERS

FIRST TIME SAVINGS ACCOUNT (FHSA)

You may be eligible to save up to $40,000 tax-free to buy a home with an annual contribution limit of $8,000.

Saving for your first home just got easier. The First Home Savings Account (FHSA) is a type of registered savings plan, designed to help you save for your first home, tax-free and help you reach your vision of owning a home faster!

What is it? Think of it as mixing together a Registered Retirement Savings Plan (RRSP) and Tax Free Savings Account (TFSA) to create a super savings account. Contributions will generally be tax-deductible (like an RRSP) and both the qualifying withdrawal and any investment growth are tax-free (like a TFSA). Therefore, reduce your taxable income and grow your investments tax-free!

Plus, the First-Time Homebuyer Incentive, which allows new owners to lower their monthly payments, has been extended until March 31, 2025.

Learn more about the First Home Savings Account

FIRST TIME HOME BUYERS’ PROGRAM

The first time home buyers' program reduces or eliminates the amount of property transfer tax you pay when you purchase your first home. If you qualify for the program, you may be eligible for either a full or partial exemption from the tax.

If one or more of the purchasers do not qualify, only the percentage of interest that the first time home buyer(s) have in the property is eligible.

For example, if you acquired 60% interest in the property and another person acquired 40% interest but only you meet the qualifications, only your 60% would receive the exemption.

Learn more about the First Time Home Buyers' Program

FIRST TIME HOME BUYERS’ TAX CREDIT

Do you know you can reduce your income taxes for the year you buy a home? It’s true. If you, your spouse or common-law partner haven’t owned a home that you've lived in, in the past 4 years, or haven’t ever owned one, you may qualify for the First-Time Home Buyers’ Tax Credit (HBTC). It's also called the Home Buyers’ Amount.

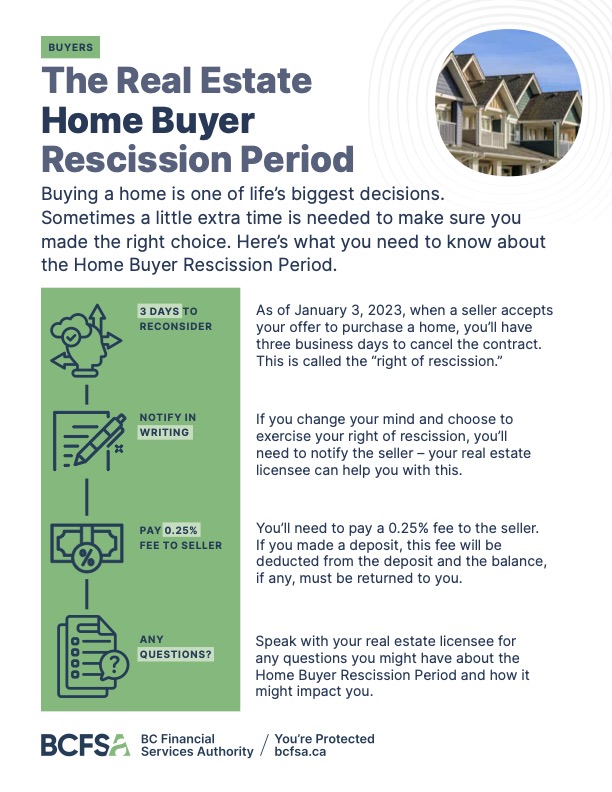

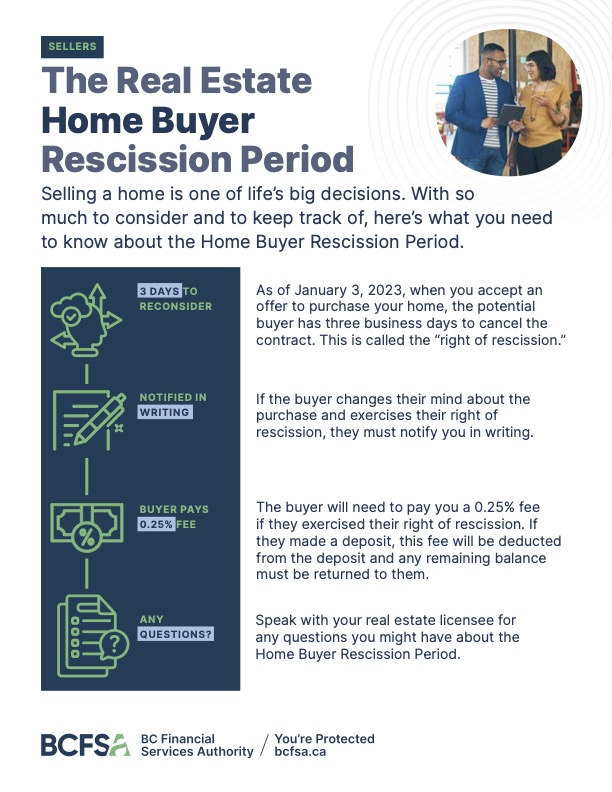

Home Buyer Rescission Period

Prepared by Brittany Loney | REALTOR®

On January 3, 2023, the B.C. government implemented the Home Buyer Rescission Period (“HBRP”) for residential real estate transactions. Also known as the “cooling-off period”, this legislation provides buyers with an opportunity to rescind their offer to purchase residential properties up to three days after an offer is accepted. If a buyer chooses to rescind their offer in the time period provided, they must pay the seller 0.25% of the offer price. This rescission period applies to residential transactions of residential real property regardless of whether a real estate licensee is involved in the transaction and cannot be waived by the buyer or seller.

Residential Properties Eligible for the HBRP

Not all properties are included in the HBRP legislation. The rescission period applies to the following types of residential properties:

- A detached house;

- A semi-detached house;

- A townhouse;

- An apartment in a duplex or other multi-unit dwelling;

- A residential strata lot, as defined in Section 1(1) of the Strata Property Act;

- A manufactured home that is affixed to land; and

- A cooperative interest, as defined in Section 1 of the Real Estate Development Marketing Act, that includes a right of use or occupation of a dwelling.

The following property types are excluded from the HBRP:

- Residential property that is located on leased land;

- A leasehold interest in residential property;

- Residential property that is sold at auction; and

- Residential property that is sold under a court order or the supervision of a court.

Important Information for Buyers

A buyer has the right to rescind a home offer within three business days after the offer is accepted, regardless of whether a real estate licensee is involved in the transaction. The three-day rescission period excludes weekends and holidays.

Only buyers can rescind a contract under the HBRP. If a buyer chooses to rescind their offer, they must:

- Notify the seller in writing before the rescission period expires; and

- Pay the seller a rescission fee. The rescission fee is 0.25% of the offer price.

Important Information for Sellers

The right to rescission cannot be waived by the buyer or the seller. The seller will receive a disclosure of the buyer’s right of rescission when an offer is made. The disclosure may be on a separate form, or included in the Contract of Purchase and Sale.

If a buyer chooses to rescind their offer and their brokerage is not holding the deposit, the seller is advised to seek legal advice for options on how to pursue the buyer for money owed.

Buyers do not need to provide a reason to sellers if they choose to rescind the contract.

BC Home Flipping Tax & Federal Property Flipping Tax

Starting January 1, 2025, the new BC Home Flipping Tax will add another layer of tax consideration for British Columbians who sell residential property within a short timeframe. This tax will be in addition to the existing federal property flipping tax introduced by the Canada Revenue Agency (CRA) in 2023. The BC home flipping tax applies to the profit you earn from selling a property in British Columbia (including presale contracts) if you owned the property for less than 730 days.

Property purchased before the tax’s effective date may be subject to the tax if sold on or after January 1, 2025 and owned for less than 730 days, unless an exemption applies.

The BC home flipping tax is separate and distinct from the federal property flipping rules and is not harmonized or administered with the federal or B.C. income tax.

Here’s a breakdown of both taxes to help REALTORS® be aware of tax considerations and know when to guide their clients to seek professional advice.

The BC Home Flipping Tax (Effective January 1, 2025)

The new BC Home Flipping Tax will be imposed in addition to the federal tax, specifically targeting short-term property sales within British Columbia. Here’s how it works:

- The tax applies to income from sales of residential properties, presale contracts, or assignments owned for less than 730 days (two years). This includes properties bought before January 1, 2025, if they are sold on or after that date and owned for less than two years.

- The rate is 20 per cent for sales within the first 365 days of ownership, gradually decreasing until it is eliminated at 730 days.

- This tax applies to any person or entity (individual, corporation, partnership, or trust) selling property within BC, regardless of residency.

- Exemptions include certain primary residences, though exemptions are subject to specific conditions and filing requirements.

The Federal Property Flipping Tax (Effective January 1, 2023)

The federal property flipping tax rule, in effect since January 2023, applies to gains from the sale of a property owned for less than 365 consecutive days. Under this rule:

- Gains are treated as business income rather than capital gains, resulting in full taxation at the individual’s tax rate.

- Principal residence exemption generally does not apply if the property is flipped, meaning it is no longer automatically tax-exempt if sold within the short period.

- Certain life events exempt property sales from this rule.

Understanding the Two Taxes

Both the BC Home Flipping Tax and the federal property flipping tax are designed to target income earned from short-term property sales, but they differ significantly in terms of applicability, administration, and exemptions.

| Aspect | ||

|

Effective Date |

January 1, 2023 |

January 1, 2025 |

|

Scope |

Applies to properties held for less than 365 days |

Applies to properties held for less than 730 days |

|

Tax Treatment |

Gains taxed as business income (no capital gains treatment) |

Additional 20 per cent tax on gains within first 365 days, decreasing to 0 per cent at 730 days |

|

Exemptions |

Some exemptions for life events (death, marriage breakdown, serious illness, eligible relocation) |

Certain exemptions may apply under the BC Home Flipping Tax. Some exemptions apply automatically, while others require filing a tax return within 90 days of the sale. |

|

Administration |

CRA |

Province of British Columbia |

The BC home flipping tax applies to the profit you earn from selling a property in British Columbia (including presale contracts) if you owned the property for less than 730 days.

Property purchased before the tax’s effective date may be subject to the tax if sold on or after January 1, 2025 and owned for less than 730 days, unless an exemption applies.

The BC home flipping tax is separate and distinct from the federal property flipping rules and is not harmonized or administered with the federal or B.C. income tax.

Who is subject to the tax?

If a person (which can include an individual, corporation, partnership or trust) sells or disposes of a taxable property on or after January 1, 2025, the profit earned from the sale would be subject to the new tax if the property was purchased less than 730 days before the sale. The seller of the property may be a B.C. resident or a resident anywhere else in the world.

Example: If you purchased a taxable property on May 1, 2023 and sold the property on January 31, 2025, the profit you earn from the sale of the property would be taxable. If you decide not to sell the property until June 1, 2025, then the profit you earn from the sale would not be subject to the tax

A disposition of a taxable property (sale of a taxable property) refers to the execution of a contract by which a beneficial interest in residential property is transferred from the seller to the purchaser in exchange for consideration in money or in kind. Therefore, for the purposes of the BC home flipping tax, a disposition of a taxable property would not generally be considered to include a:

- Deemed disposition under the Income Tax Act (Canada) or other legislation

- Mortgage, charge, or lien on a taxable property

- Lease

- Gift

- Any other transaction or event resulting in a change in legal title but not a change in beneficial ownership

Taxable properties

Taxable property refers to a beneficial interest in residential property, or a right to acquire a beneficial interest in residential property.

Generally, this means the tax will apply to the profit you earn from the sale of:

- Properties with a housing unit

- Properties zoned for residential use

- The right to acquire the above properties, such as the assignment of a purchase contract for a pre-build condo building

- The tax will not apply to exempt property locations or the leasing or sale of a leasehold interest in a property.

Do I need to file a BC home flipping tax return?

The BC home flipping tax return is separate and distinct from the annual income tax filings.

You must file a BC home flipping tax return within 90 days of the sale, if either of the following applies:

- You qualify for the tax, as you sold your property within 729 days of purchasing it and are not eligible for any exemptions

- Your exemption applies only after you file a return

You do NOT have to file a return if one of the following applies:

- You do not qualify for the tax as you sold your property after owning it for more than 729 days

- Your exemption applies without needing to file a return

- You are a developer and you are initially entering into an agreement which establishes a right to acquire a property (for example, when a developer enters into a presale agreement with an initial purchaser)

Exemptions from the tax

You may not need to pay the tax if you are eligible for an exemption. Depending on your exemption, you are either exempt only after filing a return, or can be exempt without filing a return.

How the tax is calculated

The BC home flipping tax applies to net taxable income from the sale of taxable property that was owned for less than 730 days.

The tax rate is 20 percent of net taxable income earned from a property sold within 365 days, and the rate decreases over the next 365 days. At 730 days, the tax no longer applies.

Calculate your tax: Check how much tax you need to pay with a step-by-step calculation.

Days of ownership

To determine whether you owned a property for more than 729 days, start counting with the day you purchased the property and end with the day you sold the property.

The day you purchase a property is generally the date you pay for the property. For most people, this will be the closing date, which is the date that the seller transfers ownership to you and is the time the seller is entitled to receive your money for the sale.

The day you sell a property is generally the date you receive money for the property. For most people, this will be the closing date, which is the date you transfer ownership to the purchaser and is the time you are entitled to receive the purchaser’s money for the sale.

Example 1: If you purchased a property on May 1, 2023 and sold the property on January 31, 2025, you owned the property for 642 days:

- Since you did not own the property for more than 729 days, the BC home flipping tax applies on the sale of the property

Example 2: If you purchased a property on May 1, 2023 and sold the property on May 31, 2025, you owned the property for 762 days:

- Since you owned the property for more than 729 days, the BC home flipping tax does not apply on the sale of the property

Days of ownership are determined differently if you purchased a presale contract or if you purchased from a related person.

Days of ownership for presale contracts

The day you purchase a presale contract is generally the date you pay for the contract, which is also the date you enter into the presale contract.

If you purchase the presale contract directly from a developer, this is generally the date you pay the contract deposit to the developer.

If you purchased or were assigned a presale contract and then purchase the completed property, the date you purchased or were assigned the presale contract is also considered to be the date you purchased the completed property.

Example 1: You enter into a presale contract on June 1, 2025 for a condo that will complete on March 1, 2027:

- If you buy the condo when it is completed on March 1, 2027, you will be considered to have acquired the property on June 1, 2025

The day you sell or assign a right to acquire a property, for example a presale contract, is generally the date you receive money from the purchaser or assignee for the right.

Example 2: A person enters into a presale contract on June 1, 2025 for a condo that will be completed on March 1, 2027. On December 1, 2025, the person assigns the right to buy the property to you:

- If you buy the condo when it is completed on March 1, 2027, you will be considered to have acquired the property on December 1, 2025

Days of ownership if you purchased from a related person

If a person purchases a property from a related person, the purchase date is deemed to be when the related person first purchased that property.

The purchase date is only relevant if you purchase from a related person and sell to an unrelated person. If you both purchase from and sell to a related person, you qualify for the exemption for property sales between related persons.

Example 1: If Michael purchases a property on August 1, 2025, from his father, who originally purchased that property on January 15, 2020, Michael is deemed to have purchased the property on January 15, 2020. If Michael sells the property, he will not be subject to the BC home flipping tax because he is deemed to have owned the property for more than 729 days.

Example 2: If Jennifer purchases a property on August 1, 2025, from her mother, who originally purchased that property on January 1, 2024, Jennifer is deemed to have purchased the property on January 1, 2024. Jennifer will be subject to the BC home flipping tax if she sells the property to an unrelated person on or before December 29, 2025, because she will have owned the property for less than 730 days. However, if Jennifer sells the property to an unrelated person after December 29, 2025, she will not be subject to the BC home flipping tax because she will have owned the property for more than 729 days.

If there is a series of purchases of a property between related persons, and each purchase in the series involves related parties, the last person to purchase the property is deemed to have purchased the property on the date it was purchased by the first person in the series. For this rule to apply, each person must purchase the property from a related person, but each person does not need to be related to every person involved in the series of purchases.

Example 1: John sells a property that he purchased on January 1, 2025, to his brother Steven on April 15, 2026. If Steven sells the property to his son Matthew on December 1, 2026, Matthew is deemed to have purchased the property on January 1, 2025. As John’s nephew, Mathew and John aren’t considered related persons. However, because each sale was to a related person, Matthew will still be entitled to use John’s purchase date of December 1, 2025, as his purchase date and won’t be subject to the BC home flipping unless he sells the property to an unrelated person on or before December 30, 2026.

Example 2: Corporation A owns all of the outstanding voting shares of Corporation B. Corporation B owns 51% of the outstanding voting shares of Corporation C. Corporation A purchases a property on January 1, 2025, and sells the property to Corporation B on January 1, 2026 (Corporations A and B are related persons). Corporation B then sells the property to Corporation C on February 1, 2026 (Corporation B and Corporation C are related persons). If Corporation C sells the property on March 1, 2027, it is deemed to have purchased the property on January 1, 2025, and is exempt from the BC home flipping tax.

Primary residence deduction

If you sell your primary residence and you owned the property for less than 730 days, you may be able to claim a deduction of up to $20,000 from your taxable income if you meet all of the following conditions:

- You owned the property for at least 365 consecutive days before you sold it

- The property includes a housing unit that you lived in as your primary residence while you owned it

A primary residence is defined as the place you lived in longer than any other place during the time you owned the residence. The primary residence deduction isn’t available when you assign a presale contract.

Example 1: Sam bought a house and lived in it for 20 consecutive months as his primary residence before selling the property:

- Sam owned the property for more than 365 consecutive days and the property was his primary residence during the time he owned the property, therefore, Sam is eligible for the primary residence deduction

Example 2: Amrita bought a condo and lived in it for 6 consecutive months as her primary residence before selling the property:

- Because Amrita did not own the property for at least 365 consecutive days, Amrita does not qualify for the primary residence exemption

If you sell a portion of your interest in the property, your primary residence deduction amount will be proportionate to that interest.

Curious what this means for you? Just ask me!

Information collected from BCREA, Government of British Columbia & Government of Canada.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link